General Ledger

Clients & Profits is built around a one-write, double-entry general ledger. This comprehensive, accrual accounting system automatically tracks your income, costs, and expenses using a custom, user-defined Chart of Accounts.

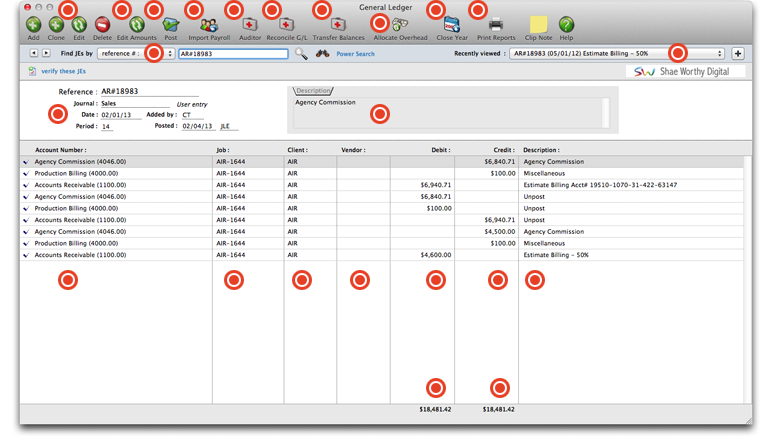

Use these buttons to add, edit, delete, or clone Journal Entries to the General Ledger. For complete step-by-step instructions, see below.

The Edit G/L Amounts window lists the transaction's debit and credit journal entries. You can edit these amounts by simply typing in the new amounts over the old ones. The total debits must equal the total credits or else your changes won't be saved. See below for step-by-step instructions.

Posting updates the account totals in your General Ledger. When a general journal transaction is added, its journal entries (there could be many) are not posted. Unposted entries can be easily and quickly changed, letting you edit an entry’s reference number, description, and other details.

Because of its frequent revisions, C&P doesn’t handle payroll accounting directly. Instead, it imports payroll from a program called CheckMark Payroll by CheckMark Software, a stand-alone system that tracks employees, deductions, and other payroll issues apart from Clients & Profits.

The Auditor performs automatic self-checks on your Accounts Payable, Accounts Receivable, and General Ledger totals. It’s used for troubleshooting data entry and posting problems. It saves users from having to print and analyze hundreds of pages of reports to find accounting problems.

The G/L Reconciliation allows you to audit your balance sheet accounts (e.g., prepaid expenses, accruals, and deposits). The vendor or client code is pulled from the journal entries to show you what vendors or clients make up the balance in that account. You can use this to prove your balance sheet account balances.

Transfer Account Balances moves a G/L account’s balances, from a selected period, to another account. This tool is helpful if you decide to reorganize your chart of accounts by renumbering some accounts or need to combine two accounts. A JE is automatically created for each accounting period in the date range selected.

The Overhead Allocation Worksheet helps calculate the true cost of servicing your clients. It works by first adding up the total hours worked by staff members on each client account, using entries from time sheets and time cards. Then the agency’s total overhead is calculated from the income statement.

Closing the year in Clients & Profits is extremely important and should be done sometime after the end of your fiscal year. C&P supports two simultaneous fiscal years for a total of 24 accounting periods, so there’s no real sense of urgency about year-end closing. The year can be closed well into the next fiscal year.

Use this button to print a multitude of GL reports (G/L Media Reconciliation, Auto-Reversing Entries, Recurring Entries), journals (General Journal, Sales Journal, Cash Receipts Journal), and audit trails.

Journal Entries can be found by reference number. Enter the number, then click the magnifying glass icon to look up JEs.

To revisit recently viewed journal entries, use this pull-down menu. Clients & Profits automatically bookmarks the last 25 journal entries viewed, making it easy to instantly see recently viewed entries, saving the time spent searching for them.

Journal entries are numbered automatically, using a sequential number beginning with JE#. To change this setting, visit Accounting Preferences. Reference numbers are customizable.

An optional description for journal entries appears here.

G/L account numbers appear here. These accounts are the basis of your accounting system, keeping monthly totals of income, costs, expenses, assets, and liabilities. The balances that appear on income statements, balance sheets, trial balances, and other financials are based on the account totals in the chart of accounts.

The job number associated with the journal entry appears in this column.

The client that the job is for appears here.

The vendor associated with the journal entry (if applicable) will appear in this column.

If the journal entry is a debit, the amount of the debit will appear in this column.

If the journal entry is a credit, the amount of the credit will appear in this column.

A brief description of the journal entry appears here.

The grand total of debits will appear here, at the bottom of the debits column.

The grand total of credits will appear here, at the bottom of the credits column.

Adding a Journal Entry

General journal entries can be added any time during the month for payroll, insurance

expenses, bank fees, etc. That is, anything that doesn’t involve Accounts Payable,

Accounts Receivable, Client Payments, Checkbook, or Employee Expense reports. All

kinds of miscellaneous entries can be added as manual journal entries: interest

income, bank service charges, transfers between bank accounts, and adjusting entries

for beginning balances.

General journal entries will appear on the bank reconciliation if they debit or

credit a checking account.

Journal entries are added in batches by transaction. Each transaction can have a

virtually unlimited number of debit and credit entries. The entries won’t be saved

unless their total debits and credits equal. New journal entries are unposted, so

they can be proofed and edited before updating the general ledger. Every journal

entry can also contain a client number, job number, and vendor number. This

information is used for printing audit trails and journals, but has no affect on

client balances, job totals, or vendor balances (to affect these balances, entries

must be added into A/P, \A/R, etc. instead).

General journal entries can be marked as recurring or auto-reversing. By checking

the “recurring” option, the same transaction will be automatically repeated in up to

23 periods. Recurring entries save you from rekeying the same depreciation,

amortization, etc. entries each month. The “auto reversing” option automatically

creates reversing debit and credit entries into the next period (i.e., the debit

entry is reversed as a credit entry, and vice versa). Auto-reversing entries keep

you from forgetting to back out entries such as month-end accruals.

Clients & Profits won't allow out of balance Journal Entries to be posted. If you

have a JE that is out of balance, it can be fixed using the Out of Balance Checker

tool in The Auditor. From the General Ledger window, choose Edit > G/L Tools > The

Auditor. Select the Out of Balance Checker, then click Start.

To add manual journal entries

1 From the General Ledger window, click the add

button (or choose Edit > Add Journal Entries).

Journal entries are numbered automatically, using a sequential number beginning with

JE# (see Accounting Preferences to change the next number). Reference numbers are

customizable.

2 Enter the transaction’s date, reference number,

period, and description. This information is the same for all debits and credits on

this journal entry.

3 Enter the first journal entry’s G/L account, an

optional job number, and a debit or credit amount.

If you’re not sure about a G/L number, leave the field blank then press Tab. The

Chart of Accounts lookup list opens, displaying your G/L accounts. Double-clicking

on an account enters it onto the journal entry.

4 Enter the transaction’s remaining debit and

credit journal entries.

If you want this transaction to be automatically reversed in the next period, click

the Auto-reversing checkbox. Auto reversing entries are posted at the same time as

their original journal entries.

5 Click Save.

To add recurring journal entries

1 From the General Ledger window, click the add

button (or choose Edit > Add Journal Entries).

2 Enter the transaction’s debits and credits, just

like you’re making a regular journal entry.

3 Click the Recurring checkbox, then click Save.

The Schedule Recurring JEs window opens (see illustration), prompting you to select

the upcoming periods into which this transaction will be posted. Click Save to save

these scheduled entries.

Recurring entries can’t be scheduled into locked accounting periods.

Recurring entries aren’t posted until the month for which they are scheduled is the

current period. They can be seen on the proof list by checking the “include

recurring entries” option.

Regular G/L entries can be scheduled. Recurring entries can be scheduled for any

unlocked period by simply clicking on the period name. A copy of the transaction’s

debit and credit JEs will be posted for each selected period

To post manual journal entries

G/L journal entries are proofed, posted, and unposted just like Accounts Payable,

checks, etc. Posting updates the balances on your financial statements and G/L

accounts.

1 Choose File > Post.

Cloning a Journal Entry

Since general journal entries don’t update the G/L balances until they are posted,

they can be easily edited and deleted.

While the General Ledger shows journal entries from all parts of Clients & Profits

(i.e., A/P, A/R, the checkbook, and Client Payments), only general journal entries

can be edited, cloned, and deleted.

To clone a journal entry

Cloning makes an exact duplicate of an existing transaction’s debit and credit

journal entries. You can clone any general journal entry, even from previous

periods.

1 Use the Find window to locate the general

journal transaction you wish to clone.

2 Choose Edit > Clone Journal Entries.

The Add Journal Entries window opens, displaying the newly-cloned transaction. The

new entry has today’s date, the current period, and the next automatic reference

number (copied from your accounting preferences). But the description and debit and

credit journal entries are identical to the original transaction.

3 Make any necessary changes to the cloned debits

and credits, then click Save.

Once saved, the cloned entry can be proofed and posted like any other entry.

Editing a Journal Entry

Since general journal entries don’t update the G/L balances until they are posted,

they can be easily edited and deleted.

While the General Ledger shows journal entries from all parts of Clients & Profits

(i.e., A/P, A/R, the checkbook, and Client Payments), only general journal entries

can be edited, cloned, and deleted.

To edit a journal entry

1 From General Ledger window, find the transaction

you wish to change.

2 Double-click on a journal entry.

The Edit Journal Entry window opens, displaying the entry’s G/L account, period,

date, description, job, client, vendor, and debit or credit amount. If the journal

entry is posted, only the description can be changed. To prevent unbalanced entries,

an entry’s accounting period and date, can’t be changed -- whether or not the entry

has been posted. The entry’s account number, reference number, description, client

number, job number, and vendor number can be changed.

3 Make your changes, then click Save.

Editing reference numbers. If you change

the reference number on one journal entry, be sure to change it on the other

entries in a transaction. Since entries are shown by reference number, entries

with different numbers won’t appear together.

Editing a Journal Entries amounts

1 Choose Edit > Edit Amounts.

The Edit G/L Amounts window lists the transaction’s debit and credit

journal entries. You can edit these amounts by simply typing in the new amounts over

the old ones.

2 Make your changes, then click Save.

The total debits must equal the total credits or else your changes won’t be saved.

Deleting a Journal Entry

Only unposted journal entries can be deleted. (Once a journal entry is posted, it

can’t be deleted -- however, adjusting entries can be made to reverse it or it can

be unposted.) Journal entries are deleted by transaction, not by individual entry,

to prevent unbalanced entries.

1 From the General Ledger window, find the

transaction you wish to delete.

2 Choose Edit > Delete

To delete all unposted journal entries, including any upcoming recurring entries,

choose Edit > Delete All Unposted JEs.

Verifying a Journal Entry

When you highlight a journal entry in the General Ledger window then click the verify button, Clients & Profits will verify the accuracy of the currently displayed journal entry. These journal entries must be posted before verifying. Clients & Profits will not verify unposted JEs. The verify function compares posted entries in the General Ledger against it's source. It will automatically fix any common problems with this posted entry.

Using the G/L Tools

Profit centers let you track the financial performance of different parts of your

business without maintaining a separate set of books. Clients & Profits Agency

provides a comprehensive set of tools to help manage your General Ledger. These

time-saving utilities are easy to use, and prevent a lot of time-consuming manual

work to audit, verify, and adjust your accounting.

Anyone with access to the General Ledger can potentially use the G/L tools. Each

tool has its own separate access privilege (see User Access & Passwords) for

flexibility. This gives different users access to some G/L tools and not others.

The G/L tools include:

Import Payroll

If you produce your own payroll checks using the CheckMark Payroll software, payroll

data can be imported into Clients & Profits. CheckMark has the ability to export

payroll information into a standard text file. Clients & Profits then imports this

text file into the General Ledger as an unposted payroll journal entries. For more

information on CheckMark Payroll, contact CheckMark at www.checkmark.com

Transfer Account Balances

A G/L account number can't be changed once it has a balance. So what happens when

you decide to reorganize your chart of accounts? One option is to wait until the

year is closed, when all of the income, cost, and expense accounts are zeroed out.

But what about asset, liability, and equity accounts that always keep their

balances? That's when you'd use the Transfer Account Balances tool. It lets you move

an account's balance to another account. It happens automatically, which simplifies

the process and keeps it more accurate.

G/L Reconciliation

The task of auditing prepaid and accrual accounts is simplified with the G/L

Reconciliation. It lists an account's entries from the General Ledger. The entries

are then marked as cleared. Once saved, the cleared items will be removed from the

reconciliation window. A G/L reconciliation report can be printed to prove your

Balance Sheet account balances.

Out of Balance Checker

The Out of Balance Checker audits your General Ledger, looking for one sided or

otherwise out-of-balance transactions. Entries will appear on the Auditing tools and

more. Each users can have different access privileges to the G/L tools. Each tool

has its own user access privilege, giving managers very specific control over who

can run them. Out of Balance Checker report shows if (1) a computer crashed during

posted and only part of a transaction was posted, (2) if a user manually entered

only one part of an adjusting journal entry, or (3) entries with the same reference

number were accidentally split over different accounting periods. The report

provides a easy-to-use checklist of the entries to fix.

Add Adjusting JE

This tool lets you make up journal entries that weren't posted with the original

transaction, typically due to a system crash or some kind of network problem during

posting. Normally, journal entries can't be saved unless the transaction's debits

equals its credits. It should only be used to fix a one-sided entry. Otherwise, the

entries you make with the Add Adjusting JE tool will make your financials out of

balance.

The Auditor

The Auditor performs automatic self-checks on your Accounts Payable, Accounts

Receivable, and General Ledger totals. It’s used for troubleshooting data entry and

posting problems. Because it automatically double-checks account totals against the

records that make them up (e.g., G/L account balances and their journal entries), it

saves users from having to print and analyze hundreds of pages of reports to find

accounting problems.

How the Auditor works:

The Auditor works by double-checking the records in your A/P, A/R, and G/L data

files. The complete auditing process includes checking for out-of-balance G/L

entries, making sure that the A/P and A/R agings equal the Balance Sheet totals, and

ensuring that billable time entries contain a client number. Each auditing step has

a different function, which is described below.

Everyone can keep working in Clients & Profits while the Auditor is working, and it

can be canceled any time without damaging the database.

The Auditor can be run any time during the month, and as frequently as needed.

Also, don’t mistake the Auditor for a traditional accountant-based financial audit.

The Auditor can only check the account totals themselves, ensuring that they add up

correctly. It can’t make value judgment about how users have entered data (for

example, it can point out that the wrong expense account was used). It doesn’t

replace a professional accounting audit. Instead, it is only a useful tool for

finding the source of accounting problems.

Auditing steps

All of the Auditor’s steps can be performed at the same time, or individual steps

can be chosen to run independently. If time allows, all of the steps can be run

together; however, if you suspect a specific problem that the Auditor can confirm

and time is tight, you can choose to run only one step at a time.

Out of Balance Checker

This step points out one-sided or otherwise unbalance journal entries from the

General Ledger. If your Trial Balance shows an out-of-balance total, the Out of

Balance Checker will show you precisely where the problem occurs. It is the same

function as the Out of Balance Checker utility in the G/L Tools menu. The only

difference is that running the Out of Balance Checker by itself lets you check one

period, instead of all periods.

Account Totals Checker

This utility compares totals on your financial statements to the journal entries in

your general ledger.

A/P Quick Check

This report compares the total of your vendor aging to the total of a/p control

accounts designated under Setup > Chart of Accounts. This is a quick way to make

sure your agings stay in balance. If the auditor shows that your A/P is out of

balance, you can rectify it with the help of the Out of Balance Prior Period Aging

Best Practice Guide.

Vendor Totals Checker

This utility compares the vendor totals listed under setup>vendors to the total

unpaid invoices on your vendor aging.

A/P Exception Report

This utility looks for incorrect uses of a/p control accounts. Example, you should

not credit accounts payable when writing a check. The a/p exception report would

flag this transaction.

A/R Quick Check

This report compares the total of your client aging to the total of a/r control

accounts designated under Setup>Chart of Accounts. This is a quick way to make sure

your agings stay in balance.

Client Totals Checker

This utility compares the client totals listed under view>clients to the total

unpaid invoices on your client aging.

A/R Exception Report

This utility looks for incorrect uses of a/r control accounts. Example, you should

not debit accounts receivable when entering a client payment. The a/r exception

report would flag this transaction.

JE Client Number Checker

The JE Client Number checker will list any je to an income or job cost account that

does not have a client code. This could affect the overhead allocation and Client P

& L report.

Time Entry Client Checker

The time entry client number checker will list any time entries in the current year

that do not have a client code. This could affect the overhead allocation and Client

P & L report.

Task Kind Checker

The task kind checker looks for tasks on open jobs that have unbilled amounts, but

the estimating/billing checkbox is not selected for that task.

To run the Auditor

1 Choose Accounting > General Ledger from the

Accounting menu.

2 Choose Edit > G/L Tools > The Auditor

The Auditor window opens.

3 Use your mouse to select the auditor steps to

perform, or click the button (i.e., All) to choose them all.

4 Click Start.

Overhead Allocation Worksheet

This tool calculates each client's share of the agency's overhead expenses for any

selected month. The overhead allocation worksheet adds up the hours worked by each

staff member, then allocates a proportion of the overhead expenses to each client

based upon the specific method. The worksheet lets you enter the month's payroll

totals for each employee, which then become part of the client's overhead

allocation. The client overhead totals are then used on the Client P&L Analysis

report.

Close Year

Clients & Profits can handle two open fiscal years, for a total of 24 accounting

periods. So while there's no real urgency to close the first year, at some point

it's necessary. Year-end closing is very easy and mostly automatic. Clients &

Profits handles everything. Once you've entered the year's remaining entries, you'll

run the Close Year procedure. It presents a checklist of steps it goes through to

close out the fiscal year. Once you've started the close year process, it runs

unattended until it finishes. Afterwards, you can print a log of steps completed by

the Close Year tool.

Auditing tools and more. Each users can have different access privileges to the G/L

tools. Each tool has its own user access privilege, giving managers very specific

control over who can run them. If you don't have access to specific G/L tools, ask

your System Manager for changes to your access privileges.

Using the Out of Balance Checker

It’s possible for your general ledger to become out-of-balance because of system

crashes during posting.

This happens when one side of a transaction (either a debit or credit) is posted,

but the system crashes before the other side is finished. The problem can happen at

any time, and it is difficult to prevent (since it is always system related). For

performance reasons, Clients & Profits doesn’t automatically warn you when you’re

out of balance. But it’s easy to see if your G/L is out of balance: simply look at

the bottom line of the Balance Sheet (it’ll show the out of balance amount), or at

Total Assets, Liabilities, and Equity section on the Trial Balance (which should

always be zero).

The key to solving an out-of-balance G/L problem is to find the missing (or

duplicated) journal entries. Since all JEs for a particular transaction have the

same reference number, it’s easy to track down the bad entries. To make

troubleshooting your G/L easy, Clients & Profits Agency provides a special Out of

Balance Checker utility.

How The Out of Balance Checker Works:

The Out of Balance Checker utility works by analyzing your G/L journal entries

transaction-by-transaction. It adds up the total of each transaction’s debits and

credits (i.e., JEs with the same reference number), then highlights the ones that

don’t balance. The Out of Balance report only shows the transactions that need

fixing.

The Out of Balance Checker only finds unbalanced entries that need to be corrected.

It does not change your general ledger in any way. You’ll need to make your own

judgments about how to correct an unbalanced entry (that is, making the appropriate

debit or credit adjusting entry).

The total debits and credits for each reference on the Out of Balance checker report

correspond to the total debits and credits in the G/L window for that transaction.

The total amount of the entries on the report should equal the out-of-balance amount

on the Balance Sheet or Trial Balance.

To run the Out of Balance Checker

1 Choose Accounting > General Ledger.

2 Choose Edit > G/L Tools > Auditor

Check totals for any period. The Out of Balance Checker can check G/L account totals

for the entire fiscal year or for a single period. If you know which period is out

of balance, checking only that period is much faster than check the entire year.

3 Select the Out of Balance Checker, then click

OK.

The journal entries are analyzed, then the Out of Balance JEs report appears. All

out of balance entries are listed and the reference numbers given for easy auditing.

You will need to research to see why the entry is out of balance by checking the

reference number in the G/L and also finding the source document. The problem is

generally in the posting and an adjusting JE needs to be added to correct the entry.

Cash vs. accrual explained

Cash basis

and accrual basis accounting are the two most widely recognized methods of

tracking a company's income and expenses. The primary difference between the two

methods has to do with when the recognition of income and expenses occur. Under

the cash method, income is recognized when a payment is received and expenses

when a check is written. This method does not let you match revenues generated

with the costs associated to them, an important financial accounting concept.

Under the accrual method (the one used by Clients & Profits), income is

recognized when the invoice is sent to the client (posted) and expenses are

recognized when the payable is recorded on the company's books. It's a better

way of recognizing income and expenses for financial purposes as it relates the

income and expenses more closely to the actual events causing them and gives you

the ability to properly match the income generated with the expenses incurred to

produce them.

Closing the year

Full guide to closing the year here.

Closing the year in Clients & Profits is extremely important and should be done

sometime after the end of your first fiscal year.

Clients & Profits supports two simultaneous fiscal years (for a total of 24

accounting periods), so there’s no real sense of urgency about year-end closing. The

year can be closed well into the next fiscal year. Throughout that time you can

enter data into both the current year and last year, then print financial statements

for any accounting period.

Once in the new fiscal year, you should run the Close Year tool as soon as you’ve

made any remaining adjusting entries. Closing is performed by a special tool that

prepares your database for the next year’s accounting work. Closing the year does

not affect job tickets, time sheets, accounts payable invoices, purchase orders,

client invoices, payments, or checks in the checkbook. Instead, closing only resets

the General Ledger.

You can’t enter accounting data into a year that is closed: Once an accounting year

is closed, its journal entries are permanently removed from the current general

ledger in preparation for the new year. Closing the year removes the journal entries

from periods 1-12. It then shifts periods 13-24 to the corresponding periods of

1-12. Closing the year gives you 12 new accounting periods to post accounting

transactions into, for a total of 24 periods.

|

Learn about the close the year process in the Clients & Profits Feature-cast. Part 1: Part 2: |

Users do not have to logout of Clients & Profits while the year is being closed, but

they should not add or post any new time entries, accounts payable invoices, client

billings, checks, client payments, deposits, or general ledger entries.

Pre-Close Year Checklist:

1 Add and post any adjusting entries into the year

being closed. Entries such as accumulated depreciation, accrued interest, and

adjusting entries you received from your tax preparer.

2 Post all unposted accounting items. Look for

unposted items by choosing Proof/Post from Accounts Payable, Checkbook, Billing:

Accounts Receivable, Client Payments, and the General Ledger. Once the year is

closed you can no longer make entries into the periods that were part of the closed

year.

3 Make sure that you have completed the

recommended monthly period closing procedures for the year being closed.

4 Print a balance sheet for Period 12 and verify

that the Suspense account has a zero balance.

The Suspense account is used as a default G/L account if you add a transaction

without a dGL or cGL account. Printing a year to date detailed G/L report for the

Suspense account will show any transactions that posted to the Suspense account.

Adjustments to the Suspense account transactions can not be made after the year is

closed if the transactions are in periods 1-12. Print this report from Snapshots >

Financials > Detailed G/L.

5 Review your Period 12 financial statements and

check all account balances for any errors you might have overlooked. If you find

something that should be corrected use the Clients & Profits Auditor tool, to help

locate and fix any errors. The Auditor tool is located in Accounting>General Ledger.

6 Review the Client Account Aging and Vendor

Account Aging reports for any issues that need to be resolved. For example, client

invoices that will not be paid and should be written off with a Write-off client

payment; and vendor invoices that will not be paid and can be removed using a vendor

credit added from the Checkbook feature.

7 Print the year end financial reports for the

year being closed as PDF files (and hard copies as well if needed).

Recommended reports:

- Balance Sheet

- Income Statement

- Trial Balance

- Detailed General Ledger

- Audit Trail (account history)

- General Ledger Journals: G/L, A/P, A/R, Checks, Payments

Also consider:

- Client Account Aging and Vendor Account Aging reports for Period 12

- Client P&L

- Budget vs Actual Reports

- Comparative financial reports

- Other financial reports you may use.

Once the year is closed financial statements, general ledger journals, audit

trails, and general ledger account detail can no longer be printed. You may

need to refer to a previous year’s journal entries some time in the future,

so having a permanent (and easily accessible) backup as PDF files or hard

copies is handy.

8 If you are using the G/L Reconciliation

Tool to reconcile accounts make sure you have reconciled the accounts

through period 12.

If you would like a an online backup of your database, we will be happy

to provide an online copy of your closed year databases for multiple

years for a flat fee.

Please call Clients & Profits Sales at 1-800-272-4488 to request this

feature before the close year process is run.

The Retained Earnings Account

The Retained Earnings account keeps track of your net income/loss from year

to year. To close the year, you must have a Retained Earnings account.

You’ll be prompted to enter the Retained Earnings account, which must be an

equity account, when closing the year. Clients & Profits calculates the

agency’s net income by subtracting job costs and overhead expenses from

total income. The amount of your profit is then posted to retained earnings,

an equity (or “net worth”) account. This is the same as manual entries which

close income, costs, and expenses into retained earnings -- it’s just

automated. Clients & Profits will prompt you if the account does not exist.

Retained Earnings is a separate Equity account, and is not the same as the

Year-to-Date Profit account 999999.00

To Close The Year

1 Choose Accounting > General Ledger, then

click on Close Year.

2 Enter your Retained Earnings account if

it is not already filled in.

The Retained Earnings account keeps track of your net income/loss from year

to year. To close the year, you must have a Retained Earnings account.

3 Click Start to close the year. Clients &

Profits will confirm that the year was closed.

4 From the Clients & Profits preferences

window review your accounting periods, current accounting period, and first

day of your fiscal year.

5 Confirm your current financials to

verify that the prior year’s ending balances were correctly transferred

during the close year process.

- Compare the balance sheet for Period 12, (that you printed before the year was closed) to the Trial Balance for Period 1, after you closed the year. The Period 12 balance sheet account balances for Asset and Liability accounts should match the Beginning Balances for Period 1 on the trial balance.

- The Retained Earnings account beginning balance will vary by the amount of the Net Earnings for the year closed. There should be no beginning balance amounts for any Income, Job Cost, Expense, Other Income, or Other Expense accounts

"Hands down, this Clients & Profits Helpdesk is the best of any support team." -- Kate Mistler, Fabiano Communications

© Clients & Profits, Inc.