Expense Reports

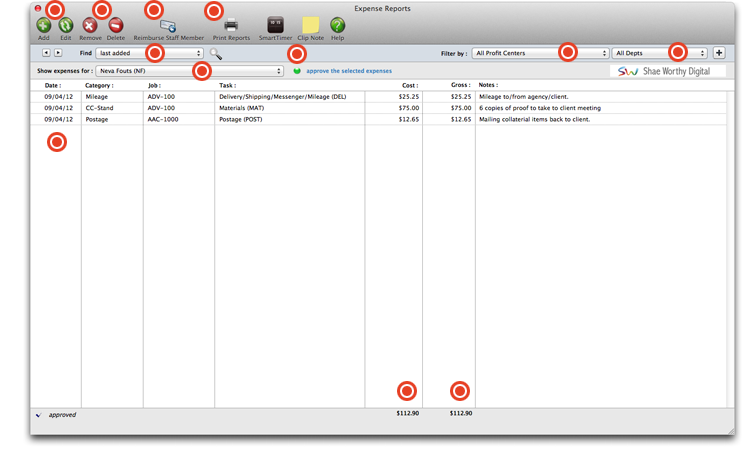

Users with access to expenses can see and approve employee daily expense reports from the Expense Reports window. The Expense Reports lets you find and review daily expense reports entered by the company’s employees.

Use these buttons to add or edit an expense report. Expense reports record all of your reimbursable out-of-pocket expenses, like tolls, client lunches, cab fares, or tips. Specific information is entered for each expense, including category, the job number and task, a description, and cost.

Click on the remove button to remove the selected expense entry. To select an expense entry, click inside any field of the expense entry. Removing an expense entry isn’t undoable. Click on the delete button to erase the entire day’s expense report and start over. Only unapproved expense reports can be deleted.

If you have the access privileges to write checks for employee expense advances and reimbursements, you can reimburse an employee for his or her expense report. Reimbursements are handled in one of two ways, depending on whether the employee got an expense advance or not. If the employee got an advance, the expense report's total is applied against the advance.

Click this button to print expense reports.

You have the option to search for expense reports by last added, unapproved expenses, or dates expense reports were approved, posted, or added.

Choose a staffer you wish to view expense reports for from this drop-down menu.

If you have the necessary access privileges, you can approve expense reports by selecting the expenses from the list and clicking this link.

You may choose to filter your search by all profit centers, or a specific profit center by choosing it from this drop-down menu.

Choose a department from this drop-down menu, or simply leave it at All Depts to show expense reports for all departments. To save your search parameters for future searches, click the + button and Clients & Profits will bookmark this search. The next time you wish to run the search, select it from the Bookmarks menu.

Select an expense from the list to edit, delete, remove, or approve it by clicking the corresponding toolbar button above.

Costs for the entire expense report are totaled at the bottom of the Cost column.

The gross amount (that will be billed to the job) of all costs on this expense report will be totaled at the bottom of the Gross column.

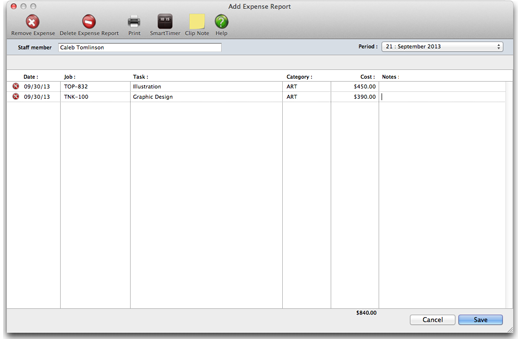

Adding a new expense report

The Expense Reports window records all of your reimbursable out-of-pocket expenses,

like tolls, client lunches, cab fares, or tips.

Specific information is entered for each expense, including category, the job number

and task, a description, and cost. The category is completely user-defined, and the

description for each expense can be as long as needed to explain how the money was

spent. Daily Expense Reports are approved for reimbursement in the Expense Reports

window.

You can add all of your daily expenses at once or as they are incurred so you can

easily keep track of the reimbursable expenses you’ve paid for out of your own

pocket.

The My Daily Expense Reports window is the electronic equivalent of a paper expense

report. Instead of filling out a paper form for the accounting department, each

staff member will enter his or her own expenses for travel, office supplies,

postage, and more into this window. The expenses are then saved directly into the

accounting system where they wait for management approval.

Approving an expense report posts the expenses to jobs and tasks and prepares the

optional reimbursement. You can only enter your own expense reports. (It’s not

possible, for example, for a receptionist to enter several employees’ expense

reports). This helps ensure that you are accountable for expense reports entered in

your name. Expense reports can only be approved by authorized manager-level users.

To approve expense reports, choose Accounting > Expense Reports.

All of the expenses entered onto a Daily Expense Report will be dated today,

regardless of when the expense was actually incurred. If you need to track an

expense’s actual date, enter the date into the description field. There is no way to

import expense reports from your Palm-based or CE-based PDA or other program.

To enter your daily expense report

1 Choose My > My Daily Expense Report

The My Daily Expense Report window opens, prompting you to enter the individual

expenses.

2 Enter the first expense's category, job, task,

description, and net cost amount.

The X column indicates that an expense has been approved by management. An approved

expense entry can’t be changed or removed.

Expense entries are grouped together by category. There is no predefined set of

categories, so any kind of category can be used here. Categories have no affect on

job costing or accounting. Instead, the category is simply used to sub-total similar

kinds of expenses together on expense summaries. The category name appears on job

cost reports in the Vendor column.

The description field is optional, but is useful for documenting expenses for

management as well as for clients. It appears on costs reports.

The cost is what you paid for the expense. It should include sales tax and any

delivery or extra charges, and should match the total on your receipt for better

accountability and easier auditing. It is not the billable amount that will be

eventually billed to the client, which will be calculated automatically when the

expense report is saved.

3 Repeat step 2 for any other expense.

4 Click Save.

Any expense on a Daily Expense Report can be edited or removed prior to it being

approved by management.

You can enter expense reports for any past or future date by clicking the Next Day or Previous

Day buttons. Once you’ve found the day you want, enter your expense

report. Additional expenses can be added to a previously saved expense report by

finding it first then adding the new entries.

Click on the previous day and next day buttons to see expense reports added on

different days.

Click on the remove expense button to delete the

selected expense entry. To select an expense entry, click inside any field of the

expense entry. Removing an expense entry isn’t undoable.

Click on the clear expenses button to erase the

entire day’s expense report and start over. Only unapproved expense reports can be

cleared.

Click the print expense report button to print a

hard copy of the currently displayed expense report.

Click on the show cost notes link to enter

a longer description for the selected expense entry.

You can find a previous entered expense report by entering any date then clicking

the Find button. If no expense report was found for a date, the Daily Expense Report

window will be blank.

Editing an expense Item

Specific information is entered for each expense, including category, the job number

and task, a description, and cost. The category is completely user-defined, and the

description for each expense can be as long as needed to explain how the money was

spent. Daily Expense Reports are approved for reimbursement in the Expense Reports

window.

You can add all of your daily expenses at once or as they are incurred so you can

easily keep track of the reimbursable expenses you’ve paid for out of your own

pocket.

The My Daily Expense Reports window is the electronic equivalent of a paper expense

report. Instead of filling out a paper form for the accounting department, each

staff member will enter his or her own expenses for travel, office supplies,

postage, and more into this window. The expenses are then saved directly into the

accounting system where they wait for management approval.

Approving an expense report posts the expenses to jobs and tasks and prepares the

optional reimbursement. You can only enter your own expense reports. (It’s not

possible, for example, for a receptionist to enter several employees’ expense

reports). This helps ensure that you are accountable for expense reports entered in

your name. Expense reports can only be approved by authorized manager-level users.

To approve expense reports, choose Accounting > Expense Reports.

All of the expenses entered onto a Daily Expense Report will be dated today,

regardless of when the expense was actually incurred. If you need to track an

expense’s actual date, enter the date into the description field. There is no way to

import expense reports from your Palm-based or CE-based PDA or other program.

To edit your daily expense report

1 Choose My > My Daily Expense Report

The My Daily Expense Report window opens, listing your individual expenses.

2 Edit the first expense's category, job, task,

description, and net cost amount.

The X column indicates that an expense has been

approved by management. An approved expense entry can’t be changed or removed.

Expense entries are grouped together by category. There is no predefined set of

categories, so any kind of category can be used here. Categories have no affect on

job costing or accounting. Instead, the category is simply used to sub-total similar

kinds of expenses together on expense summaries. The category name appears on job

cost reports in the Vendor column.

The job and task

are optional, although they are needed for tracking job costs. If the expense was

incurred for a client job, be sure to enter a job and task.

The description field is optional, but is useful

for documenting expenses for management as well as for clients. It appears on costs

reports.

The cost is what you paid for the expense. It should include sales tax and any

delivery or extra charges, and should match the total on your receipt for better

accountability and easier auditing. It is not the billable amount that will be

eventually billed to the client, which will be calculated automatically when the

expense report is saved.

3 Continue editing for any other expense.

4 Click Save.

Any expense on a Daily Expense Report can be edited or removed prior to it being

approved by management.

You can enter expense reports for any past or future date by clicking the Next Day or Previous

Day buttons. Once you’ve found the day you want, enter your expense

report. Additional expenses can be added to a previously saved expense report by

finding it first then adding the new entries.

Click on the previous day and next day buttons to see expense reports added on

different days.

Click on the remove expense button to delete the

selected expense entry. To select an expense entry, click inside any field of the

expense entry. Removing an expense entry isn’t undoable.

Click on the clear expenses button to erase the

entire day’s expense report and start over. Only unapproved expense reports can be

cleared.

Click the print expense report button to print a

hard copy of the currently displayed expense report.

Click on the show cost notes link to enter

a longer description for the selected expense entry.

You can find a previous entered expense report by entering any date then clicking

the Find button. If no expense report was found for a date, the Daily Expense Report

window will be blank.

Removing an expense item

1 Find an expense report you wish to edit, using

the previous day or next day button.

2 Select the item in the expense report by

clicking on it.

3 Click the remove button.

4 An alert will appear asking if you wish to

remove this expense item.

Deleting an expense report

1 Find the expense report you wish to delete, using

the previous day or next day button.

2 Click the delete button.

3 An alert will appear asking if you wish to

delete this expense report.

Approving an expense report

1 Find an expense report, using the previous day or

next day button.

2 Click the approve button.

3 An alert will appear asking if you wish to

approve this expense report.

Reimbursing employees for expenses

If you have the access privileges to write checks for employee expense advances and

reimbursements, you can reimburse an employee for his or her expense report.

Reimbursements are handled in one of two ways, depending on whether the employee got

an expense advance check or not:

1. If the employee got an advance check, the

expense report’s total is applied against the advance, where either the company will

owe the employee additional funds when he or she spent more than the advance amount,

or the employee will owe the company additional funds when he or she spent less than

the advance amount:

(a) If the company owes the

employee money, a check can be written automatically for the reimbursement

amount ( "Write check" in the "Reimburse how:" options).

(b) If the employee owes the company money,

then enter the employee’s check number used to pay the reimbursement amount to

the company ("Add staff payment " in the "Reimburse how:" options).

2. If the employee did not receive an advance

check (used his or her own funds to cover all the expenses), the total of their

expense report can be reimbursed as an A/P invoice ( "Add A/P invoice " in the

"Reimburse how:" options). The employee will then be paid in the next check run

along with the other vendors. To automatically add an A/P for the reimbursement, the

staff member needs their own vendor ID (Setup > Vendors). Their vendor ID needs to

be entered into their Edit Staff Member window to associate their vendor ID with

their staff ID.

Reimbursing employees for expenses with an advance

check

The employee spent less than the amount of the advance check, so he or she owes the

company the difference.

1 Find the expense report to reimburse by using

either the find tool or scrolling using the previous and next toolbar buttons.

2 Click the reimburse toolbar button.

3 Choose the employee expense advance check from

the pop-up list.

The balance of the employee expense advance check will automatically appear, along

with the expense report’s total cost, and the reimbursement amount.

Note: If the employee

entered multiple expense reports (i.e.. over multiple days) that in total are

less than the advance amount, do not use the reimburse feature. C&P only makes

the correct accounting entries into the G/L if all the employee's expenses are

on one report where the total of the expense report plus the reimbursement

amount from the employee equals the amount of the advance check.

4 Click OK.

Clients & Profits will automatically choose the Add Staff Payment option.

5 Enter the employee’s check number and optional

batch number (used for the bank reconconcilation).

6 Click OK.

The employee spent more than the amount of the advance check, so the company owes he

or she additional funds.

Follow Steps 1-3 above.

Clients & Profits will automatically choose the Write Check option, and the

difference between the employee advance and the expense report is automatically

entered in the Reimbursement Amount field.

Note: If the employee

entered multiple expense reports (i.e.. over multiple days) that in total are

more than the advance amount, do not use the reimburse feature. C&P only makes

the correct accounting entries into the G/L if all the employee's expenses are

on one report where the total of the expense report less the reimbursement

amount from the company equals the amount of the advance check.

4 Click OK in the Expense Reimbursement window.

The reimbursement check is automatically posted, so all you have to do is print the

check and give it to the employee to reimburse them for their additional

out-of-pocket expenses.

Reimbursing employees for expenses without an advance

check

Follow Steps 1-2 above, but do not select an

advance check (leave it as None).

3 Enter the amount to reimburse the employee.

4 Select Add A/P Invoice.

5 Click OK, then click Yes to the message to add

the reimbursement payable.

The employee will be reimbursed at the next vendor invoice check run. Or, pay this

invoice with a vendor payment immediately if the employee needs the funds now.

"Hands down, this Clients & Profits Helpdesk is the best of any support team." -- Kate Mistler, Fabiano Communications

© Clients & Profits, Inc.