Adding a Media Accrual Invoice

Media accrual invoices complete a WIP (i.e., work-in-process) accounting procedure that started with the client’s media billing. Tracking media accruals automatically is complex and requires accurate entry of both media billings to clients and media invoices from vendors.

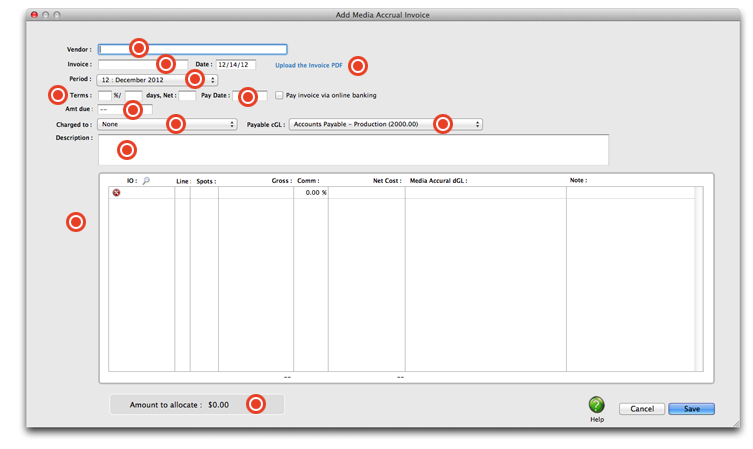

Enter the invoice’s vendor (i.e., publication or station), number here.

Enter the invoice number in this field and date from the printed invoice.

The current accounting period (from Accounting Preferences) is entered automatically, but can be changed by choosing a period from the pop-up menu. Any unlocked accounting period can be chosen, giving you the flexibility to match up the media’s cost with the client’s media billing, if needed.

If you have a copy of the invoice you're paying in PDF format, you can attach it by clicking here, locating the PDF and clicking Save.

The payment terms are copied from the vendor account, but can be changed. If the vendor offers an early-payment discount, be sure to enter its percentage and days to pay; the A/P aging and cash flash reports will calculate the invoice’s discounted balance automatically.

The invoice total is amount you’re being charged by the vendor, including sales tax and shipping but not commissions or early-payment discounts. The credit G/L is your media payables account. If you have a separate AP liability account for Media Payables. Each vendor can be setup with a different AP account that will be used instead of the default account in Preferences.

The pay date is day on which you’ll schedule this invoice to be paid. Enter it here. If you would like to pay this invoice online, select the pay invoice via online banking checkbox.

Media Accrual invoices can be charged to a credit card by selecting one from the "Charged to" pop-up menu. By doing this, you can later clear Media Accrual invoices paid by a credit card and add remaining charges in one step in the Add Credit Card Statement window.

The credit G/L is your media payables account. If you have a separate AP liability account for Media Payables. Each vendor can be setup with a different AP account that will be used instead of the default account in Preferences.

Enter an optional description for this Media Accrual Invoice.

If you’re not sure about the order number, press Tab to open the PO lookup list. The line number is important, because it points to the exact line item on the order. It’s the only way to reconcile orders with many line items. For broadcast orders, the quantity of spots that actually ran is compared with the quantity ordered. The gross amount is what the client was billed for the media buys.

The total amount to be allocated will be displayed here.

Adding a media accrual invoice

1 From the Accounts Payable, window, choose Edit >

Add New Invoice > Media Accrual Invoice.

2 Enter the invoice’s vendor (i.e., publication or station), number.

3 Enter the invoice number and date from the printed invoice.

4 Choose an accounting period from the pop-up menu.

The current accounting period (from Accounting Preferences) is entered automatically, but can be

changed by choosing a period from the pop-up menu. Any unlocked accounting period can be chosen,

giving you the flexibility to match up the media’s cost with the client’s media billing, if needed.

5 Enter the vendor’s payment terms, especially the pay date.

The payment terms are copied from the vendor account, but can be changed. If the vendor offers an

early-payment discount, be sure to enter its percentage and days to pay; the A/P aging and cash flash

reports will calculate the invoice’s discounted balance automatically. The pay date is day on which

you’ll schedule this invoice to be paid.

6 Enter the invoice amount due and its credit (i.e., liability) G/L

account.

The invoice total is amount you’re being charged by the vendor, including sales tax and shipping but

not commissions or early-payment discounts. The credit G/L is your media payables account. If you have

a separate AP liability account for Media Payables. Each vendor can be setup with a different AP

account that will be used instead of the default account in Preferences.

7 Enter the insertion order or broadcast order number for the first

cost amount.

If you’re not sure about the order number, press Tab to open the PO lookup list. The lookup list shows

only the vendor’s open orders. Double-clicking on an insertion or broadcast order copies it to this

media invoice.

8 Enter the insertion order or broadcast order’s line number.

The line number is entered automatically as 1, meaning the first line item from the insertion order.

The line number is important, because it points to the exact line item on the order. It’s the only way

to reconcile orders with many line items.

If the purchase order wasn’t pre-billed, you’ll get this message:

Only pre-billed insertion or broadcast orders can be reconciled by media accrual invoices.

9 Enter the number of spots that ran for this order line item.

For broadcast orders, the quantity of spots that actually ran is compared with the quantity ordered.

The broadcast order keeps track of the number of spots over and under the plan, which can be

summarized on reports then billed or credited to the client. For print insertion orders, leave this

field empty.

10 Enter the spot’s total gross amount, commission percentage, and

net amount.

The gross amount is what the client was billed for the media buys. The commission percentage is used

to calculate the spot’s net amount, which is the amount your agency will pay for these ads.

11 Enter the cost of media dGL, or debit account.

The media cost account is copied from Preferences, but can be changed.

12 Repeat steps 7-11 for the invoice’s remaining line items.

13 Click Save.

Once the invoice is posted, the media’s cost will be debited to the media cost account and the

invoice’s total will be credited to Accounts Payable. In addition, entries will be posted to the media

WIP accounts, reversing the accrual JEs posted from the media billing.

"Hands down, this Clients & Profits Helpdesk is the best of any support team." -- Kate Mistler, Fabiano Communications

© 2025 Clients & Profits, Inc.