Budget amounts can be quickly set up for any or all accounts and periods using last

year’s totals. Account totals can roll up into other accounts. The accounts are set

up with the rollup information in the Chart of Accounts. Choose the Rollup option

when printing financials to rollup, or hide, the account totals in the designated

account. Accounts can also be made confidential. Confidential accounts work like

regular accounts, but can’t be used by non-managers. They don’t appear on the

printed account list or the lookup list.

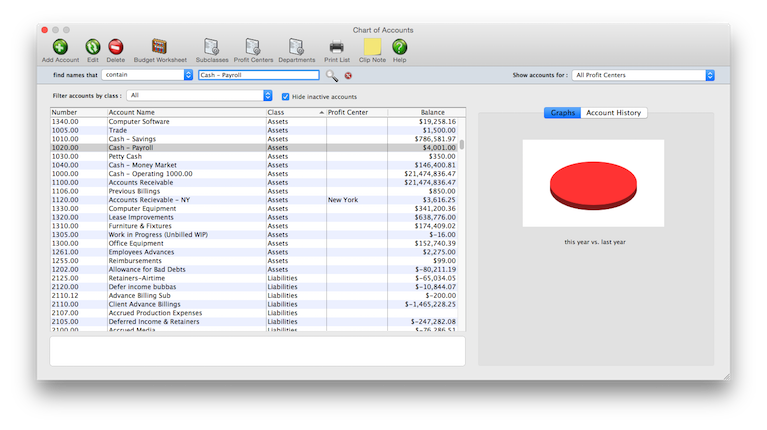

You can add, edit, and delete accounts from your Chart of Accounts anytime (except

for accounts with activity). Accounts with activity can be edited (except the

number) and reclassified, but not deleted.

Account numbers

There are no rigid rules about numbering G/L accounts, although the number has a

limited length (9-digits, which includes a decimal point and 2 decimals places to

indicate the account’s department). You choose your own account numbers, so you can

use any numbering system that conforms to accounting standards. Also, the same

account number can’t be used twice. Account numbers are numeric, so they can’t

contain letters or characters (i.e., dashes, etc.). An account number can’t be

changed if the account has activity (i.e., journal entries) or a balance. Account

numbers can’t contain leading zeros (e.g., 001000).

Since G/L account numbers are numbered fields, all of your account numbers should

have the same length -- the same number of digits. Otherwise, when printing a G/L

accounts list, your accounts will print out of order. For example, 1100.00, 1101.00,

1102.00, etc., instead of 5, 12, 300, 1102, etc.

Accounts are categorized three ways: a major class (e.g., asset, liability, sales,

etc.), a subclass (e.g., current assets, fixed assets, etc.), and a profit center.

The class organizes accounts as assets, liabilities, equities, sales, costs,

expenses, other income, income taxes, or other expenses.

Asset, liability, and equity accounts appear on the Balance Sheet. Income

(billings), costs, expenses, other income, income taxes, and other expenses appear

on the Income Statement. All accounts appear on the Trial Balance and the Detailed

General Ledger. The classes themselves are preset, but their names can be changed in

Preferences.

Accounts are subtotaled within each class using a subclass. Subclasses are optional

and user-defined, so you can create as many as needed. An account’s subclass can be

edited anytime. Each account can belong to one profit center and one department.

Profit centers are user-defined, so you can create as many as needed. Financial

statements can be printed for one profit center at a time, or all profit centers.

Clients & Profits has the ability to pre-program standard, or default, accounts into

your database. These default accounts are entered automatically when payables,

checks, receivables, and client payments are added. Default accounts can be

overridden by simply entering an account number when a transaction is added.

Default account numbers can be entered for these accounts: Cash/Checking; Accounts

Receivable; Accounts Payable; Client Retainers; Billing/Income; Employee Advances;

Media Accruals; Media Costs; Overhead Expenses; Retained Earnings; Advance Billings;

A/R Discount Given; A/P Discount Taken. Default G/L accounts are optional, but can

help make your accounting more consistent and reduce errors. The default account

numbers are entered in the G/L accounts Preferences window.

The Year-to-Date Net Income and Retained Earnings accounts are necessary to your

financial statements. The year-to-date net income account (which is always 999999)

is calculated each time a financial statement is printed. The account’s balance is

always the income less costs and expenses. While the account number can’t be

changed, you can name the account whatever you want. You can’t post entries directly

to the YTD income account; instead, entries should be posted to income, costs,

expenses, or Retained Earnings.

The Retained Earnings account tracks net income (or loss) from the previous

accounting years. It’s an equity account of your choosing. The account is only used

at year-end closing and for adjustments. Unlike the year-to-date net income account,

you can post journal entries to the Retained Earnings account when you need to

adjust last year’s ending balances.

The suspense account (999998) is updated when the program isn’t able to find the

account entered on the transaction. It’s an important account because it acts as a

safety net when the wrong account, or no account, is entered. When entries are found

in the suspense account, they are reversed out of suspense and into the correct

account.